Greek Tragedy:Germany ... Ιnsists !

(...)

three main creditors — the European Commission, the European Central Bank and the International Monetary Fund — are wrong to combine legitimate demands for market reforms with destructive demands for austerity measures. These include private-sector pay cuts, which would deepen Greece’s severe recession, further reducing its ability to pay debts.

Greece’s recession is three years old. Unemployment is approaching 20 percent. Living standards have sharply declined; health care has been gutted. Meanwhile, Greece’s debt to gross domestic product ratio keeps rising(...)

Germany insists that only further cuts to public spending and private wages will somehow force Greek politicians into reforming the economy (and convince German voters to approve more bailout money).

But that approach has been tried and has become the biggest obstacle to reform

(...)

three main creditors — the European Commission, the European Central Bank and the International Monetary Fund — are wrong to combine legitimate demands for market reforms with destructive demands for austerity measures. These include private-sector pay cuts, which would deepen Greece’s severe recession, further reducing its ability to pay debts.

Greece’s recession is three years old. Unemployment is approaching 20 percent. Living standards have sharply declined; health care has been gutted. Meanwhile, Greece’s debt to gross domestic product ratio keeps rising(...)

Germany insists that only further cuts to public spending and private wages will somehow force Greek politicians into reforming the economy (and convince German voters to approve more bailout money).

But that approach has been tried and has become the biggest obstacle to reform

(...)

Greek Tragedy

''New York Times''

Published: February 8, 2012

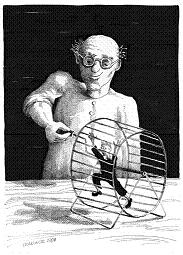

A stubborn standoff is playing out this week between a nearly bankrupt Greece and the wrongheaded European partners it needs to pay its bills. The outcome is, sadly, foreordained. Greece will have to give Europe all or most of what it wants. It cannot survive without Europe’s money, even if it chokes on Europe’s conditions. By now, Europe’s leaders should know this approach will not work.

Chancellor Angela Merkel of Germany, the main architect of Europe’s disastrous mismanagement of the euro-zone debt crisis, can keep pretending that harsher doses of fiscal austerity will restore Greece and Europe’s other troubled debtors to economic health. Or she can recognize that only a combination of greater fiscal breathing room and pro-growth reforms — like opening up closed labor markets, breaking up state monopolies and streamlining bureaucracies — can achieve the desired result. But slashing wages, jobs and public spending across the board, as Europe demands, will only deepen recession.

Greece has contributed mightily to its problems. For years, the government falsified deficit numbers it provided to Europe, giving it cover to amass unpayable debts. A new government elected in 2009 blew the whistle, accepted a European Union bailout deal and then failed to deliver on market-opening reforms. With austerity measures shrinking the economy and tax receipts and European Union blunders raising interest rates, it also missed deficit targets. Europe’s frustration is understandable. It is right to insist on market reforms from Greece’s political parties before delivering $171 billion in the next round of bailout money, which Greece needs by March.

But negotiators for Greece’s three main creditors — the European Commission, the European Central Bank and the International Monetary Fund — are wrong to combine legitimate demands for market reforms with destructive demands for austerity measures. These include private-sector pay cuts, which would deepen Greece’s severe recession, further reducing its ability to pay debts.

Greece’s recession is three years old. Unemployment is approaching 20 percent. Living standards have sharply declined; health care has been gutted. Meanwhile, Greece’s debt to gross domestic product ratio keeps rising. Even a pending 70 percent write-down of existing government debt by private sector creditors will not reduce it to sustainable levels. Germany insists that only further cuts to public spending and private wages will somehow force Greek politicians into reforming the economy (and convince German voters to approve more bailout money). But that approach has been tried and has become the biggest obstacle to reform.

In a democracy, majorities can be mobilized against special interests if they can see the economic benefit to their own lives. By forcing all Greeks to suffer with no real prospects of relief, Europe is uniting the country, now beset by strikes, against further reforms. Greek politicians are worried that embracing austerity measures too willingly would be political suicide in this spring’s elections. They need to pledge themselves to carry out pro-growth market opening reforms no matter which party wins those elections. But they will not be able to keep such promises if harsher austerity is the price of a deal.

(O τίτλος,η υπογράμμιση-χρωματισμός και η εικονογράφηση του κειμένου των αναρτήσεων- με εικόνες απο το World-Wide Web -γίνονται με ευθύνη του blogger: ''IVOS 2'')