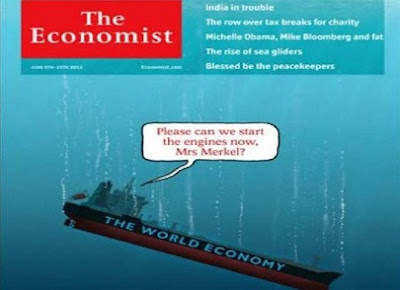

- Please can we start the engines now, Mrs. Merkel ?

(...)

if the euro collapses, then Germany will suffer hugely. The downgrading of some of its banks this week was a portent of that. Moreover, the undoubted mistakes in Greece, Ireland, Portugal, Italy, Spain and the other debtor countries have been compounded over the past three years by errors in Europe’s creditor countries. The overwhelming focus on austerity; the succession of half-baked rescue plans; the refusal to lay out a clear path for the fiscal and banking integration that is needed for the single currency to survive: these too are reasons why the euro is so close to catastrophe. And since Germany has largely determined this response, most of the blame belongs in Berlin.

if the euro collapses, then Germany will suffer hugely. The downgrading of some of its banks this week was a portent of that. Moreover, the undoubted mistakes in Greece, Ireland, Portugal, Italy, Spain and the other debtor countries have been compounded over the past three years by errors in Europe’s creditor countries. The overwhelming focus on austerity; the succession of half-baked rescue plans; the refusal to lay out a clear path for the fiscal and banking integration that is needed for the single currency to survive: these too are reasons why the euro is so close to catastrophe. And since Germany has largely determined this response, most of the blame belongs in Berlin.

(...)

Κυρία Μέρκελ πάρτε αποφάσεις πριν είναι αργά

Η εμμονή στην λιτότητα και τα πακέτα διάσωσης που αποδείχτηκαν ημίμετρα

Το τάνκερ «Παγκόσμια Οικονομία» που βυθίζεται και η παράκληση ενός επιβαίνοντα στην Γερμανίδα καγκελάριο Άνγκελα Μέρκελ να βάλουν τώρα τις μηχανές μπρος κοσμούν το εξώφυλλο του Economist στο προσεχές τεύχος του: η βρετανική εφημερίδα ζητά και πάλι από την Μέρκελ να πάρει αποφάσεις γιατί ο χρόνος εξαντλείται και όλος ο πλανήτης είναι πλέον σε κίνδυνο.

Η παραπαίουσα ανάπτυξη και ο κίνδυνος καταστροφής στην οικονομία έχει βάλει σε δύσκολο δρόμο την παγκόσμια οικονομία. Ακόμα και οι αναδυόμενες οικονομίες «έχουν χτυπήσει στον τοίχο», σημειώνει το «editorial».

Η αποδυνάμωση του ευρώ και το χάος από μία ενδεχόμενη ελληνική έξοδο από το κοινό νόμισμα, οι διαφωνίες των πολιτικών και τα λιγοστά πυρομαχικά που έχουν οι κεντρικές τράπεζες, στήνουν ένα δύσκολο σκηνικό.

«Είναι τώρα στα χέρια των Ευρωπαίων πολιτικών να αντιμετωπίσουν οριστικά και αποφασιστικά το θέμα του ευρώ», τονίζει. Η πειστική λύση δεν εγγυάται ομαλότητα στην παγκόσμια οικονομία· η αδυναμία εξεύρεσης εγγυάται την οικονομική τραγωδία, υπογραμμίζει.

Ο Economist βλέπει ότι αναμφίβολά έγιναν λάθη στην Ελλάδα, την Ιταλία, την Ισπανία και την Ιρλανδία αλλά και από τους πιστωτές τους. Η εμμονή στην λιτότητα και τα πακέτα διάσωσης που αποδείχτηκαν ημίμετρα, η καθυστέρηση της τραπεζικής ενοποίησης έφεραν το ευρώ κοντά στην καταστροφή με μεγάλες ευθύνες του Βερολίνου.

Τι μπορεί να γίνει τώρα; Η πεποίθηση της Μέρκελ ότι η λιτότητα και η μη παροχή πακέτων βοήθειας θα φέρει τη μεταρρύθμιση της Ευρώπης αρχίζει να κοστίζει όλο και περισσότερο. Ακόμη όλο και λιγότερο πιθανή φαίνεται η δυνατότητα της Γερμανίας να τη βγάλει καθαρή από την κρίση λέει ο Economist.

Η παραπαίουσα ανάπτυξη και ο κίνδυνος καταστροφής στην οικονομία έχει βάλει σε δύσκολο δρόμο την παγκόσμια οικονομία. Ακόμα και οι αναδυόμενες οικονομίες «έχουν χτυπήσει στον τοίχο», σημειώνει το «editorial».

Η αποδυνάμωση του ευρώ και το χάος από μία ενδεχόμενη ελληνική έξοδο από το κοινό νόμισμα, οι διαφωνίες των πολιτικών και τα λιγοστά πυρομαχικά που έχουν οι κεντρικές τράπεζες, στήνουν ένα δύσκολο σκηνικό.

«Είναι τώρα στα χέρια των Ευρωπαίων πολιτικών να αντιμετωπίσουν οριστικά και αποφασιστικά το θέμα του ευρώ», τονίζει. Η πειστική λύση δεν εγγυάται ομαλότητα στην παγκόσμια οικονομία· η αδυναμία εξεύρεσης εγγυάται την οικονομική τραγωδία, υπογραμμίζει.

Ο Economist βλέπει ότι αναμφίβολά έγιναν λάθη στην Ελλάδα, την Ιταλία, την Ισπανία και την Ιρλανδία αλλά και από τους πιστωτές τους. Η εμμονή στην λιτότητα και τα πακέτα διάσωσης που αποδείχτηκαν ημίμετρα, η καθυστέρηση της τραπεζικής ενοποίησης έφεραν το ευρώ κοντά στην καταστροφή με μεγάλες ευθύνες του Βερολίνου.

Τι μπορεί να γίνει τώρα; Η πεποίθηση της Μέρκελ ότι η λιτότητα και η μη παροχή πακέτων βοήθειας θα φέρει τη μεταρρύθμιση της Ευρώπης αρχίζει να κοστίζει όλο και περισσότερο. Ακόμη όλο και λιγότερο πιθανή φαίνεται η δυνατότητα της Γερμανίας να τη βγάλει καθαρή από την κρίση λέει ο Economist.

Χρειάζεται πλέον ένα σαφές και συγκεκριμένο σχέδιο πριν από τη Σύνοδο Κορυφής της 28ης Ιουνίου ακόμα και νωρίτερα αν το αποτέλεσμα των εκλογών στην Ελλάδα τρομάξει τις αγορές.

Το κόστος για την ίδια την Μέρκελ μπορεί να είναι η δυσαρέσκεια στο εσωτερικό αλλά τα οφέλη μπορεί να έρθουν και πάλι γιατί θα έχει αποκατασταθεί η εμπιστοσύνη και «η παγκόσμια οικονομία θα έχει κάνει ένα τεράστιο βήμα μακριά από την καταστροφή».

«Κυρία Μέρκελ είναι στο χέρι σας», καταλήγει ο Economist.

Το κόστος για την ίδια την Μέρκελ μπορεί να είναι η δυσαρέσκεια στο εσωτερικό αλλά τα οφέλη μπορεί να έρθουν και πάλι γιατί θα έχει αποκατασταθεί η εμπιστοσύνη και «η παγκόσμια οικονομία θα έχει κάνει ένα τεράστιο βήμα μακριά από την καταστροφή».

«Κυρία Μέρκελ είναι στο χέρι σας», καταλήγει ο Economist.

''BHMA''

7-6-2012

ΣΧΕΤΙΚΑ

Start the engines, Angela

The world economy is in grave danger. A lot depends on one woman

“TO THE lifeboats!” That is the stark message bond markets are sending about the global economy. Investors are rushing to buy sovereign bonds in America, Germany and a dwindling number of other “safe” economies. When people are prepared to pay the German government for the privilege of holding its two-year paper, and are willing to lend America’s government funds for a decade for a nominal yield of less than 1.5%, they either expect years of stagnation and deflation or are terrified of imminent disaster. Whichever it is, something is very wrong with the world economy.

That something is a combination of faltering growth and a rising risk of financial catastrophe. Economies are weakening across the globe. The recessions in the euro zone’s periphery are deepening. Three consecutive months of feeble jobs figures suggest America’s recovery may be in trouble (see article). And the biggest emerging markets seem to have hit a wall. Brazil’s GDP is growing more slowly than Japan’s. India is a mess (see article). Even China’s slowdown is intensifying. A global recovery that falters so soon after the previous recession points towards widespread Japan-style stagnation.

Βut that looks like a good outcome when set beside the growing danger of a fracturing of the euro. The European Union, the world’s biggest economic area, could plunge into a spiral of bank busts, defaults and depression—a financial calamity to dwarf the mayhem unleashed by the bankruptcy of Lehman Brothers in 2008. The possibility of a Greek exit from the euro after its election on June 17th, the deterioration of Spain’s banking sector and the rapid disintegration of Europe’s cross-border capital flows have all increased this danger (see article). And this time it will be harder to counter. In 2008 central bankers and politicians worked together to prevent a depression. Today the politicians are all squabbling. And even though the technocrats at the central banks could (and should) do more, they have less ammunition at their disposal.

Made in Athens, made worse in Berlin

Nobody wants to test these various disaster scenarios. It is now up to Europe’s politicians to deal finally and firmly with the euro. If they come up with a credible solution, it does not guarantee a smooth ride for the world economy; but not coming up with a solution guarantees an economic tragedy. To an astonishing degree, the fate of the world economy depends on Germany’s chancellor, Angela Merkel (see article).

In one way it seems unfair to pick on Mrs Merkel. Politicians everywhere are failing to act—from Delhi, where reform has stalled, to Washington, where partisan paralysis threatens a lethal combination of tax increases and spending cuts at the end of the year. Within Europe, as Germans never cease to point out, investors are not worried about Mrs Merkel’s prudent government, whose predecessor restructured the economy painfully ten years ago; the problem is a loss of confidence in less well-run, unreformed countries.

But do not get too sympathetic. To begin with, past virtue counts for little at the moment: if the euro collapses, then Germany will suffer hugely. The downgrading of some of its banks this week was a portent of that. Moreover, the undoubted mistakes in Greece, Ireland, Portugal, Italy, Spain and the other debtor countries have been compounded over the past three years by errors in Europe’s creditor countries. The overwhelming focus on austerity; the succession of half-baked rescue plans; the refusal to lay out a clear path for the fiscal and banking integration that is needed for the single currency to survive: these too are reasons why the euro is so close to catastrophe. And since Germany has largely determined this response, most of the blame belongs in Berlin.

Be bold, bitte

Outside Germany, a consensus has developed on what Mrs Merkel must do to preserve the single currency. It includes shifting from austerity to a far greater focus on economic growth; complementing the single currency with a banking union (with euro-wide deposit insurance, bank oversight and joint means for the recapitalisation or resolution of failing banks); and embracing a limited form of debt mutualisation to create a joint safe asset and allow peripheral economies the room gradually to reduce their debt burdens. This is the refrain from Washington, Beijing, London and indeed most of the capitals of the euro zone. Why hasn’t the continent’s canniest politician sprung into action?

Her critics cite timidity—and they are right on one count. Mrs Merkel has still never really explained to the German people that they face a choice between a repugnant idea (bailing out their undeserving peers) and a ruinous reality (the end of the euro). One reason why so many Germans oppose debt mutualisation is because they (wrongly) imagine the euro could survive without it. Yet Mrs Merkel also has a braver twin-headed strategy. She believes, first, that her demands for austerity and her refusal to bail out her peers are the only ways to bring reform in Europe; and, second, that if disaster really strikes, Germany could act quickly to save the day.

The first gamble can certainly claim some successes, notably the removal of Silvio Berlusconi in Italy and the passage, across southern Europe, of reforms that would recently have seemed unthinkable. But the costs of this strategy are rising fast. The recessions spawned by excessive austerity are rendering it self-defeating. Across much of Europe debt burdens are rising, along with the appeal of political extremes. The uncertainty caused by the muddle-through approach is draining investors’ confidence and increasing the risk of a euro disaster.

As for Germany’s idea that it could all be saved at the last minute, by, for instance, the European Central Bank (ECB) flooding a country with liquidity, that looks risky. Were Spain to see a full-scale bank run, even an emboldened Mrs Merkel might not be able to stop it. If Greece falls out, yes, the German public would be more convinced that sinners would be punished; but, as this newspaper has argued before, a “Grexit” would cause carnage in Greece and contagion around Europe. Throughout this crisis, Mrs Merkel has refused to come up with a plan bold enough to stun the markets into submission, in the same way that America’s TARP programme did.

In short, even if her strategy has paid some dividends, its cost has been ruinous and it has run its course. She needs to lay out a clear plan for the single currency, at the latest by the European summit on June 28th, earlier if Greece’s election spreads panic. It must be specific enough to dispel all doubt about Germany’s commitment to saving the euro. And it must include immediate downpayments on deeper integration, such as a pledge to use joint funds to recapitalise Spanish banks.

This would risk losing her support at home. Yet with these risks comes the possibility of rapid reward. Once Germany’s commitment to greater integration is clear, the ECB would have the room to act more robustly—both to buy many more sovereign bonds and to provide a bigger backstop for banks. With the fear of calamity diminished, a vicious cycle would become virtuous as investors’ confidence recovered.

The world economy would still have to grapple with ineptitude elsewhere and with weak growth. But it would have taken a giant step back from disaster. Mrs Merkel, it’s up to you.

ΠΗΓΗ